Food Distribution Program Tables

For information on all Food Distribution programs (and on food distributed in child nutrition programs), see the USDA Foods home page. Here you can access regulations, information on available commodities, and links to other agencies concerned with USDA Foods distribution.

National Level Summary Tables

Fiscal Years 1969-2024

- Cost of Food Distribution Programs

Nutrition Services Incentive Program (NSIP, formerly Nutrition Program for the Elderly), Food Distribution on Indian Reservations (FDPIR), Commodity Supplemental Food (CSFP), Emergency Food Assistance (TEFAP) - Participation (FDPIR and CSFP) or Meals Served (NSIP)

State Level Tables

Fiscal Years 2020-2024

Food distribution program data.

Child Nutrition Tables

This factsheet provides information on the child nutrition programs. Also see the child nutrition home page for the latest news and further information.

National Level Annual Summary Tables: FY 1969-2024

- National School Lunch Program (NSLP) - Participation and Meals Served: PDF | Excel

- School Breakfast Program (SBP) - Participation and Meals Served: PDF | Excel

- Special Milk Program (SMP) - Outlets and Milk Served: PDF | Excel

- NSLP, SBP and SMP - Program Costs (cash and commodities): PDF | Excel

- Child and Adult Care Food Program - Participation, Meals and Costs: PDF | Excel

- Summer Food Service Program - Participation, Meals and Costs: PDF | Excel

National Level Monthly Data

- National School Lunch Program - PDF | Excel

- School Breakfast Program - PDF | Excel

- Child and Adult Care Program - PDF | Excel

State Level Tables: FY 2020-2024

National School Lunch Program

- Participation - PDF | Excel

- Meals Served - PDF | Excel

- Cash Payments - PDF | Excel

- Commodity Costs - PDF | Excel

School Breakfast Program

Special Milk Program

Child and Adult Care Food Program

Summer Food Service Program

State Level Table Current Activity

Child nutrition program data.

Comment Request - SNAP Supplemental Nutrition Assistance for Victims of Disaster

Summary

The authority to operate the Disaster Supplemental Nutrition Assistance Program (D-SNAP) is found in section 5(h) of the Food and Nutrition Act of 2008, formerly the Food Stamp Act of 1977, as amended and the Disaster Relief Act of 1974, as amended by the Robert T. Stafford Disaster Relief and Assistance Act of 1988 authorizes the Secretary of Agriculture to establish temporary emergency standards of eligibility for victims of a disaster if the commercial channels of food distribution have been disrupted, and subsequently restored. D-SNAP is a program that is separate from the Supplemental Nutrition Assistance Program (SNAP) and is conducted for a specific period of time. In order for a state to request to operate a D-SNAP, an affected area in the state must have received a Presidential Declaration of “Major Disaster” with Individual Assistance.

Need and Use of the Information

This information collection concerns information obtained from state agencies seeking to operate D-SNAP. A state agency request to operate a D-SNAP must contain the following information: Description of incident; geographic area; application period; benefit period; eligibility criteria; ongoing household eligibility; affected population; electronic benefit card issuance process; logistical plans for Disaster SNAP rollout; staffing; public information outreach; duplicate participation check process; fraud prevention strategies; and employee application procedures. The Food and Nutrition Service reviews the request to ensure that all the necessary requirements to conduct a D-SNAP are met. If this collection is not conducted, D-SNAP would not be available to help meet the nutritional needs of disaster victims.

Request for Comments

Comments regarding this information collection received by Dec. 26, 2025 will be considered. Written comments and recommendations for the proposed information collection should be submitted within 30 days of the publication of this notice on RegInfo.gov. Find this particular information collection by selecting "Currently under 30-day Review - Open for Public Comments" or by using the search function. An agency may not conduct or sponsor a collection of information unless the collection of information displays a currently valid OMB control number and the agency informs potential persons who are to respond to the collection of information that such persons are not required to respond to the collection of information unless it displays a currently valid OMB control number.

This information collection concerns information obtained from state agencies seeking to operate D-SNAP.

Fiscal Year 2026 D-SNAP Income Eligibility Standards

| DATE: | September 16, 2025 |

|---|---|

| SUBJECT: | SNAP – Fiscal Year 2026 D-SNAP Income Eligibility Standards |

| TO: | All State Agencies Supplemental Nutrition Assistance Program |

This memorandum provides the fiscal year (FY) 2026 income standards and maximum allotments for the Disaster Supplemental Nutrition Assistance Program (D-SNAP). State agencies may use these standards to determine eligibility for D-SNAP, as well as the maximum allotment for eligible households may receive based on their size.

D-SNAP is a similar, yet distinct, program from SNAP that provides temporary food assistance to households affected by a natural disaster. State agencies may request D-SNAP for areas that receive a Presidential disaster declaration of Individual Assistance. Households that are eligible for D-SNAP receive a temporary, one-month benefit equal to the maximum SNAP benefit allotment for their household size. Eligibility is based on household size and income. The D-SNAP benefit allotment is determined by household size. Please see the tables below for the income limits and allotments.

Early and ongoing communication is critical as FNS remains available to assist state agencies in their evaluation of whether and when D-SNAP is appropriate. For example, ensuring that local infrastructure and food retailers are up and running are important steps for determining D-SNAP readiness.

State agencies must find a balance between responding quickly, operating efficiently, and protecting program integrity. Effective D-SNAP fraud prevention strategies begin in the preplanning phase. FNS is available to provide technical assistance to support state agencies in developing their requests and establishing strong internal controls to prevent fraud, waste, and abuse of this important disaster assistance. State agencies with questions regarding D-SNAP should contact their respective regional office representatives.

Ronald Ward

Acting Associate Administrator

Supplemental Nutrition Assistance Program

Food and Nutrition Service

U.S. Department of Agriculture

Option 1: Disaster Gross Income Limit (DGIL)

The Disaster Gross Income Limit (DGIL) combines the SNAP maximum monthly net income limit, the maximum standard income deduction, and the maximum capped shelter expense deduction for the current fiscal year. In order to be eligible under DGIL, a household’s take-home income and accessible liquid resources during the disaster benefit period, minus disaster expenses as determined by the state agency, must not exceed the income limit for its size.

| Household Size | Income Limit | Allotment |

|---|---|---|

| 1 | $2,258 | $298 |

| 2 | $2,716 | $546 |

| 3 | $3,174 | $785 |

| 4 | $3,647 | $994 |

| 5 | $4,143 | $1,183 |

| 6 | $4,639 | $1,421 |

| 7 | $5,098 | $1,571 |

| 8 | $5,556 | $1,789 |

| Each Additional Member | +$459 | +$218 |

| Household Size | Income Limit | Allotment (Urban) | Allotment (Rural 1) | Allotment (Rural 2) |

|---|---|---|---|---|

| 1 | $3,177 | $385 | $491 | $598 |

| 2 | $3,750 | $707 | $901 | $1,097 |

| 3 | $4,323 | $1,015 | $1,295 | $1,576 |

| 4 | $4,897 | $1,285 | $1,639 | $1,995 |

| 5 | $5,470 | $1,529 | $1,950 | $2,374 |

| 6 | $6,059 | $1,838 | $2,344 | $2,853 |

| 7 | $6,633 | $2,031 | $2,590 | $3,152 |

| 8 | $7,206 | $2,314 | $2,950 | $3,591 |

| Each Additional Member | +$574 | +$282 | +$360 | +$438 |

| Household Size | Income Limit | Allotment |

|---|---|---|

| 1 | $2,598 | $439 |

| 2 | $3,056 | $806 |

| 3 | $3,514 | $1,157 |

| 4 | $3,998 | $1,465 |

| 5 | $4,533 | $1,743 |

| 6 | $5,067 | $2,095 |

| 7 | $5,526 | $2,315 |

| 8 | $5,984 | $2,637 |

| Each Additional Member | +$459 | +$322 |

| Household Size | Income Limit | Allotment |

|---|---|---|

| 1 | $2,796 | $506 |

| 2 | $3,323 | $929 |

| 3 | $3,851 | $1,334 |

| 4 | $4,378 | $1,689 |

| 5 | $4,913 | $2,010 |

| 6 | $5,484 | $2,415 |

| 7 | $6,012 | $2,668 |

| 8 | $6,539 | $3,040 |

| Each Additional Member | +$528 | +$371 |

| Household Size | Income Limit | Allotment |

|---|---|---|

| 1 | $2,075 | $383 |

| 2 | $2,533 | $703 |

| 3 | $2,992 | $1,009 |

| 4 | $3,489 | $1,278 |

| 5 | $3,985 | $1,521 |

| 6 | $4,481 | $1,827 |

| 7 | $4,940 | $2,019 |

| 8 | $5,398 | $2,300 |

| Each Additional Member | +$459 | +$281 |

Option 2: Disaster Standard Expense Deduction Option (DSED)

State agencies may simplify calculating eligibility for D-SNAP by using the Disaster Standard Expense Deduction (DSED), which uses a standard amount for a household’s disaster expenses, which includes food loss.

Note: Only households with actual, unreimbursed disaster expenses equal to or greater than $100 may qualify using DSED. DSED cannot be used when food loss is the only qualifying disaster expense.

| Household Size | Net Income Limit | Standard Deduction | Shelter Cap | Disaster Expenses | Income Limit | Allotment |

|---|---|---|---|---|---|---|

| 1 | $1,305 | $209 | $744 | $1,011 | $3,269 | $298 |

| 2 | $1,763 | $209 | $744 | $1,527 | $4,243 | $546 |

| 3 | $2,221 | $209 | $744 | $1,696 | $4,870 | $785 |

| 4 | $2,680 | $223 | $744 | $2,086 | $5,733 | $994 |

| 5 | $3,138 | $261 | $744 | $2,171 | $6,314 | $1,183 |

| 6 | $3,596 | $299 | $744 | $2,410 | $7,049 | $1,421 |

| 7 | $4,055 | $299 | $744 | $2,486 | $7,584 | $1,571 |

| 8 | $4,513 | $299 | $744 | $2,561 | $8,117 | $1,789 |

| Each Additional Member | +$459 | Not Applicable | Not Applicable | Not Applicable | +$533 | +$218 |

This memorandum provides the fiscal year 2026 income standards and maximum allotments for the Disaster Supplemental Nutrition Assistance Program (D-SNAP). State agencies may use these standards to determine eligibility for D-SNAP, as well as the maximum allotment for eligible households may receive based on their size.

Information Collection: State Administrative Expense Funds

Summary

In accordance with the Paperwork Reduction Act of 1995, this notice invites the general public and other public agencies to comment on this proposed information collection. This collection is a revision of a currently approved collection for state administrative expense funds expended in the operation of the child nutrition programs administered under the Child Nutrition Act of 1966.

Request for Comments

Written comments must be received on or before Nov. 10, 2025.

Comments may be sent to Penny Burke, Chief, Operational Support Branch, Food and Nutrition Service, U.S. Department of Agriculture, 1320 Braddock Place, Alexandria, VA 22314. Comments may also be submitted via email to Penny.Burke@usda.gov. Comments will also be accepted through the Federal eRulemaking Portal. Go to Regulations.gov, and follow the online instructions for submitting comments electronically. All responses to this notice will be summarized and included in the request for Office of Management and Budget (OMB) approval and will become a matter of public record.

Abstract

Section 7 of the Child Nutrition Act of 1966 (PL 89-642), 42 USC 1776, authorizes the Department to provide federal funds to state agencies (SAs) for administering the Child Nutrition Programs (7 CFR parts 210, 215, 220, 226 and 250). State Administrative Expense (SAE) Funds, 7 CFR part 235, sets forth procedures and recordkeeping requirements for use by SAs in reporting and maintaining records of their need and use of SAE funds. A summary of the reporting and recordkeeping burden associated with this revision is presented in the table below.

The FNS-525 State Administrative Expense Funds Reallocation Report is used by the state agencies to report information related to the SAE funds. 7 CFR 235.5(d) states that “Annually, between March 1 and May 1 on a date specified by FNS, of each year, each state agency shall submit to FNS a State Administrative Expense Funds Reallocation Report (FNS-525) on the use of SAE funds.” This report will be used to reallocate SAE funds.

The FNS-777 Financial Status Report was formerly associated with this collection. However, due to revisions made to FNS-525 for the 2022 renewal, completion of FNS-525 now provides all of the required information and it is no longer necessary to obtain information from the FNS-777. Therefore, the recordkeeping requirement and burden associated with FNS-777 is being removed from the collection. FNS-777 and its associated burden is approved under OMB Control Number 0584-0594 Food Programs Reporting System (FPRS) (expiration date Sept. 30, 2026) and is therefore not included in this collection. Removing this recordkeeping requirement will reduce 216 responses and 54 burden hours from the recordkeeping burden, due to a program change, resulting in a new overall burden of 3,075 responses and 6,252 hours for this collection.

This collection is a revision of a currently approved collection for state administrative expense funds expended in the operation of the child nutrition programs administered under the Child Nutrition Act of 1966.

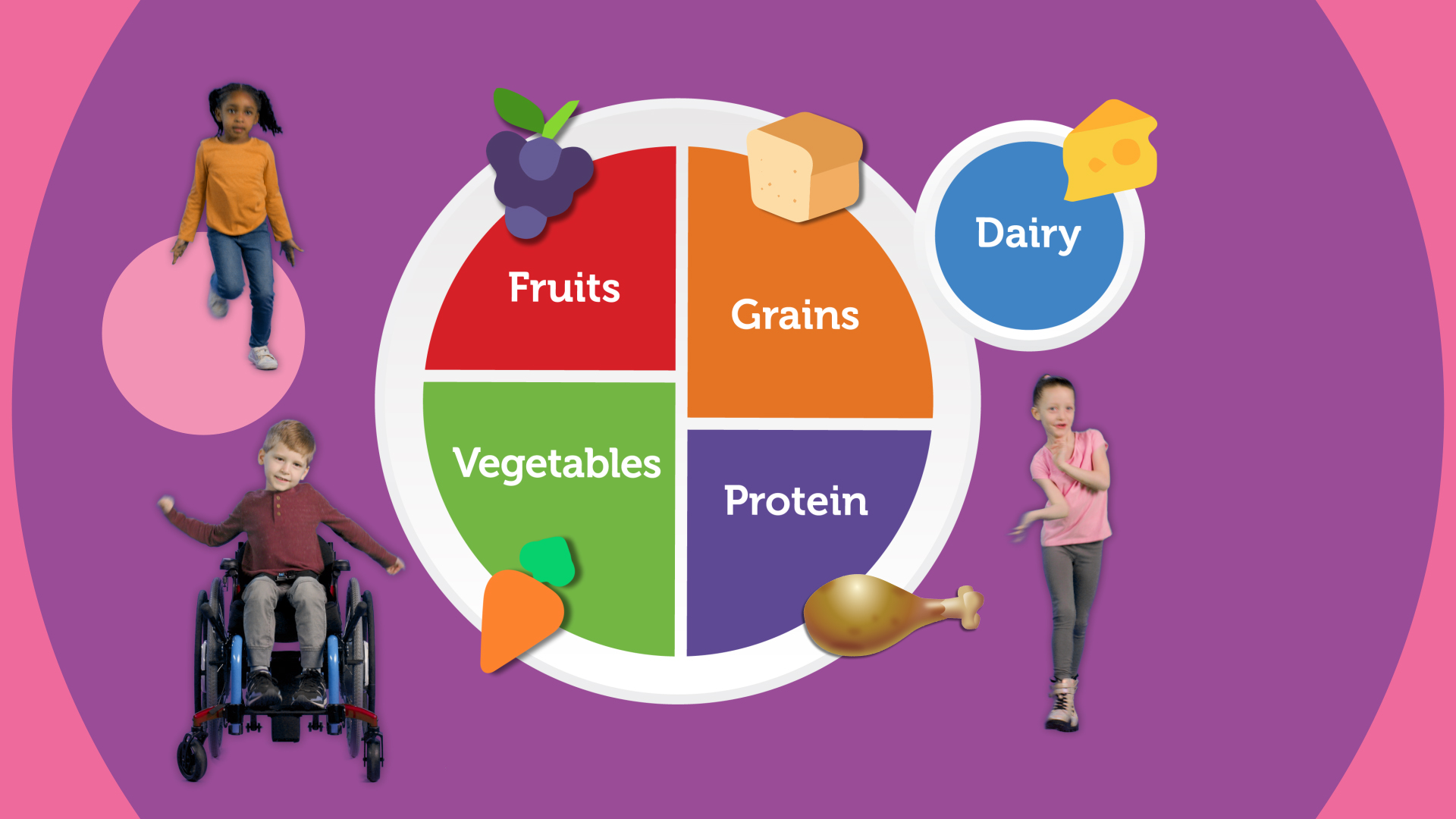

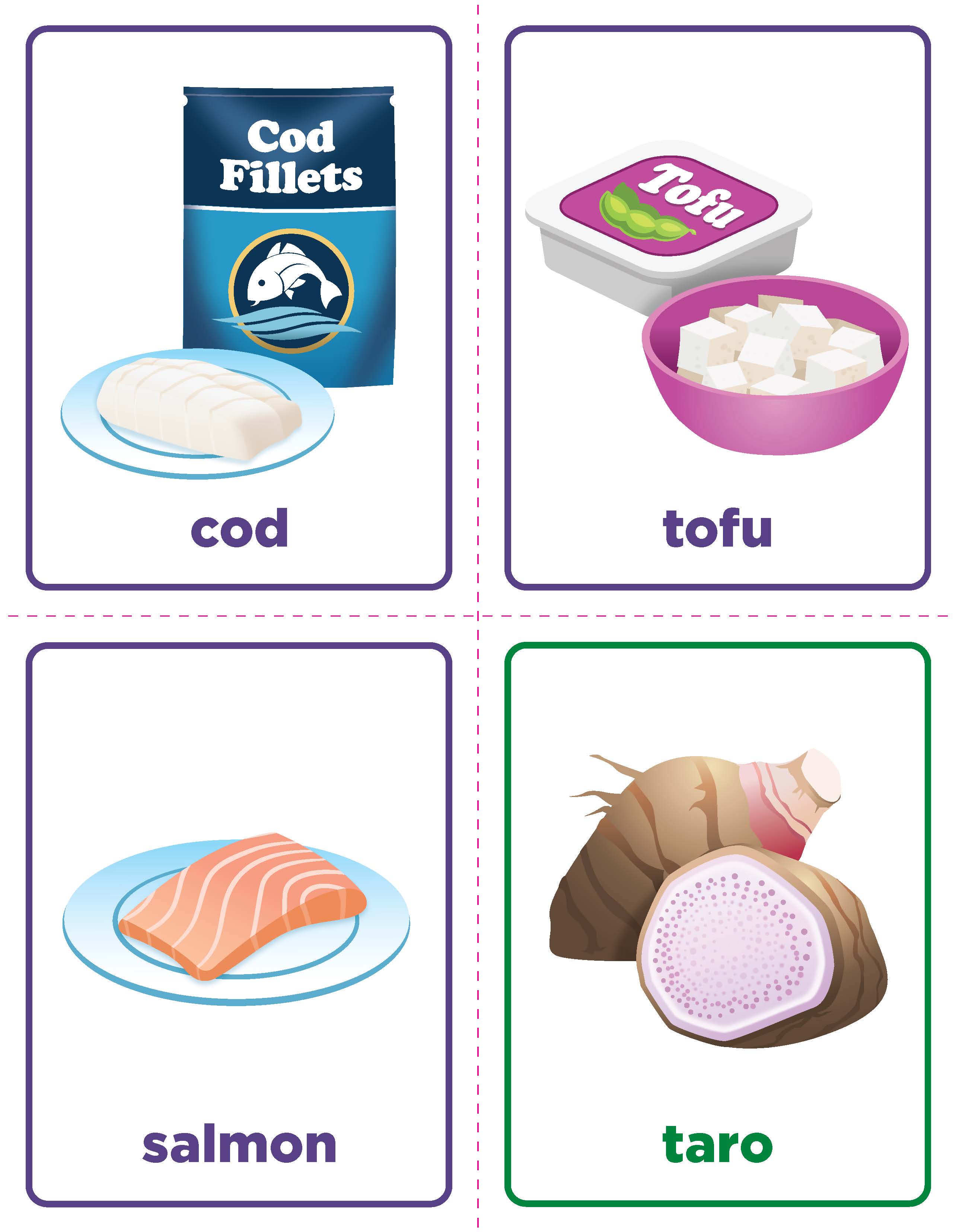

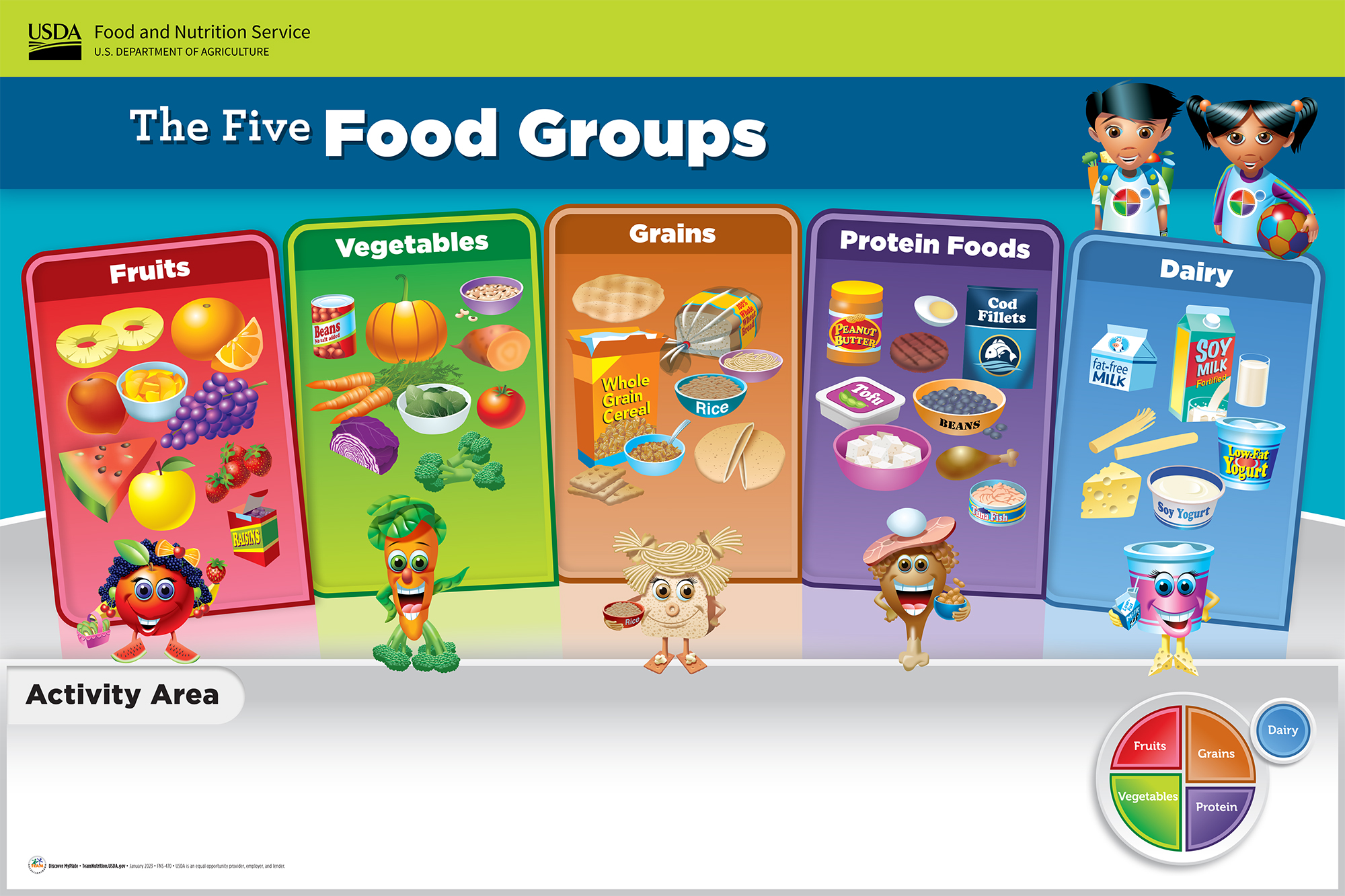

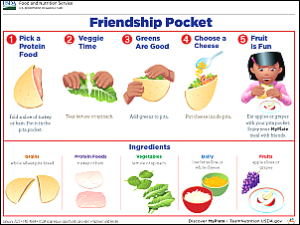

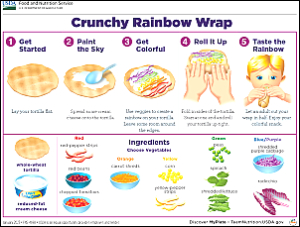

Discover MyPlate: Nutrition Education for Kindergarten

Explore the expanded edition of Discover MyPlate: Nutrition Education for Kindergarten. The updated set includes additional food cards and fun new resources showing where food comes from.

Discover MyPlate is fun and inquiry-based nutrition education that fosters the development of healthy food choices and physically active lifestyles during a critical developmental and learning period for children—kindergarten.

Kindergarten teachers can meet education standards for math, science, English language arts, and health using the six ready-to-go and interactive lessons. Children become food-smart as they practice counting, reading, writing, and more.

Availability

All are welcome to download these materials and make copies. To download the files, please right-click on the link and select "save link as."

Videos

For Teachers

For Kindergarteners

Emergent Reader Mini Books

Student Workbook

Look and Cook Recipe Cards

For Parents and Families

Parent Handouts

Graphics

On this page

Explore the expanded edition of Discover MyPlate: Nutrition Education for Kindergarten. The updated set includes additional food cards and fun new resources showing where food comes from.

CSFP: Announcement of Update to the Food Package Maximum Monthly Distribution Rates, Effective Sept. 1, 2025

| DATE: | August 11, 2025 | |

|---|---|---|

| SUBJECT: | Commodity Supplemental Food Program (CSFP): Announcement of Update to the Food Package Maximum Monthly Distribution Rates, Effective Sept. 1, 2025 | |

| TO: | Regional Directors Special Nutrition Programs All Regional Offices | State Directors CSFP State Agencies and Indian Tribal Organizations |

In alignment with Agriculture Secretary Brooke Rollins’ priorities to encourage healthy choices, healthy outcomes, and healthy families and connect America’s farmers to nutrition assistance programs, the USDA Food and Nutrition Service (FNS) is revising the CSFP Maximum Monthly Distribution Rates to reflect the foods currently available in the program.

These revised guide rates, outlined in Attachment A, will be effective on Sept. 1, 2025 and remain in effect until further notice. There are no changes to the maximum amounts of foods that may be distributed in each food package category. CSFP state agencies should use the guide rates in conjunction with the latest CSFP Foods Available List.

Thank you for your commitment to providing one of our nation’s most vulnerable populations with nutritious, minimally processed American grown and produced foods to support their health and well-being.

Director

Policy Division

Supplemental Nutrition and Safety Programs

Director

Food Safety and Nutrition Division

Supplemental Nutrition and Safety Programs

Attachment A - CSFP Maximum Monthly Distribution Rates

These rates are effective Sept. 1, 2025 until further notice.

| Food Package Category | Food Item | Amount Each Month |

|---|---|---|

| Fruits and Juice | Canned Fruit (15.5 ounces) Juice (64 ounces) Raisins (15 ounces) |

|

| Vegetables | Canned Vegetables or Soup (10.5–15.5 ounces) Dehydrated Potatoes (1 pound) |

|

| Cheese | Cheese (2 pounds) | 1 package cheese |

| Milk | UHT Fluid Milk 1% (32 ounces) Instant Nonfat Dry Milk (12.8 ounces) |

|

| Meat, Poultry, and Fish | Beef or Beef Stew (24 ounces) Beef Chili with Beans (15 ounces) Chicken (10–12.5 ounces) Tuna (12 ounces) Salmon (14.75 ounces) |

|

| Plant-Based Protein | Canned Beans (15.5 ounces) Dry Beans or Lentils (1 pound) Peanut Butter (16 ounces) | 3 units of any combination of canned beans, dry beans or lentils, and peanut butter |

| Cereals | Cereal, Ready-to-Eat (10–20 ounces) Farina (18 ounces) Rolled Oats (18 ounces) Grits (2 pounds) | 2 units of any combination of cereal, farina, rolled oats, and grits |

| Pasta and Rice | Pasta (1 pound) Rice (1 pound) | 2 units of any combination of pasta and rice |

In alignment with Agriculture Secretary Brooke Rollins’ priorities to encourage healthy choices, healthy outcomes, and healthy families and connect America’s farmers to nutrition assistance programs, we are revising the CSFP Maximum Monthly Distribution Rates to reflect the foods currently available in the program.

Interim Final Rule: NSLP and SBP - Elimination of the State Ameliorative Action Reporting Requirement for School Meals Eligibility Verification

Summary

Due to a technical problem with the docket that prevented comments from being accepted during part of the initial comment period, we are reopening the comment period for the interim final rule that appeared in the Federal Register on June 6, 2025. The rule rescinds an unnecessary reporting requirement for the school meals application verification process.

Request for Comments

The comment period for the rule published June 6, 2025, at 90 FR 24049, is reopened. Comments must be received on or before Sept. 8, 2025.

Comments can be submitted through the Federal e-rulemaking portal at https://www.regulations.gov and should reference the document number and the date and page number of this issue of the Federal Register . We strongly prefer comments to be submitted electronically. However, written comments may be submitted (i.e., postmarked) via mail to Docket No. FNS-2025-0008, FNS, USDA, 1320 Braddock Place, Alexandria, VA 22314. All comments submitted in response to this notice will be included in the record and will be made available to the public.

Please be advised that the identity of individuals or entities submitting comments will be made public on the internet at the address provided above. Parties who wish to comment anonymously may do so by entering “N/A” in the fields that would identify the commenter. A plain language summary of this notice of interim final rule is available at https://www.regulations.gov in the docket for this rulemaking.

Supplementary Information

On June 6, 2025, at 90 FR 24049, FNS published in the Federal Register an interim final rule entitled “National School Lunch Program and School Breakfast Program: Elimination of the State Ameliorative Action Reporting Requirement for School Meals Eligibility Verification.”

The interim final rule provided for a 30-day comment period, which would have ended July 7, 2025. However, on or about July 1, we learned that the public comments were not being accepted to the Federal eRulemaking Portal at www.regulations.gov.

We informed staff at the Federal eRulemaking Portal and the issue has been resolved. Nevertheless, given the uncertainty regarding the time that the portal was not operational, we have determined that a thirty-day reopening of the comment period, to Sept. 8, 2025, is appropriate. This reopening will allow interested persons who may have tried unsuccessfully to submit comments additional time to do so.

Due to a technical problem with the docket that prevented comments from being accepted during part of the initial comment period, we are reopening the comment period for the interim final rule that appeared in the Federal Register on June 6, 2025. The rule rescinds an unnecessary reporting requirement for the school meals application verification process.

National School Lunch, Special Milk, and School Breakfast Programs, National Average Payments/Maximum Reimbursement Rates SY 2025-26

Summary

This Notice announces the annual adjustments to the national average payments, the amount of money the federal government provides states for lunches, afterschool snacks, and breakfasts served to children participating in the National School Lunch and School Breakfast Programs; to the maximum reimbursement rates, the maximum per lunch rate from federal funds that a state can provide a school food authority for lunches served to children participating in the National School Lunch Program; and to the rate of reimbursement for a half-pint of milk served to non-needy children in a school or institution that participates in the Special Milk Program for Children. The annual payments and rates adjustments for the National School Lunch and School Breakfast Programs reflect changes in the Food Away From Home series of the Consumer Price Index for All Urban Consumers. The annual rate adjustment for the Special Milk Program reflects changes in the Producer Price Index for Fluid Milk Products. Further adjustments are made to these rates to reflect higher costs of providing meals in Alaska, Guam, Hawaii, Puerto Rico, and Virgin Islands. The payments and rates are prescribed on an annual basis each July.

Dates

These rates are in effect from July 1, 2025, through June 30, 2026.

Supplementary Information

Background

Special Milk Program for Children—Pursuant to section 3 of the Child Nutrition Act of 1966, as amended (42 USC 1772), the Department announces the rate of reimbursement for a half pint of milk served to non-needy children in a school or institution that participates in the Special Milk Program for Children. This rate is adjusted annually to reflect changes in the Producer Price Index for Fluid Milk Products, published by the Bureau of Labor Statistics of the Department of Labor.

National School Lunch and School Breakfast Programs—Pursuant to sections 11 and 17A of the Richard B. Russell National School Lunch Act, (42 USC 1759a and 1766a), and section 4 of the Child Nutrition Act of 1966 (42 USC 1773), the Department annually announces the adjustments to the National Average Payment Factors and to the maximum federal reimbursement rates for lunches and afterschool snacks served to children participating in the National School Lunch Program and breakfasts served to children participating in the School Breakfast Program. Adjustments are prescribed each July 1, based on changes in the Food Away From Home series of the Consumer Price Index for All Urban Consumers, published by the Bureau of Labor Statistics of the Department of Labor.

Lunch Payment Levels—Section 4 of the Richard B. Russell National School Lunch Act (42 USC 1753) provides general cash for food assistance payments to states to assist schools in purchasing food. The Richard B. Russell National School Lunch Act provides two different section 4 payment levels for lunches served under the National School Lunch Program. The lower payment level applies to lunches served by school food authorities in which less than 60 percent of the lunches served in the school lunch program during the second preceding school year were served free or at a reduced price. The higher payment level applies to lunches served by school food authorities in which 60 percent or more of the lunches served during the second preceding school year were served free or at a reduced price.

To supplement these section 4 payments, section 11 of the Richard B. Russell National School Lunch Act (42 USC 1759 (a)) provides special cash assistance payments to aid schools in providing free and reduced-price lunches. The section 11 National Average Payment Factor for each reduced-price lunch served is set at 40 cents less than the factor for each free lunch.

As authorized under sections 8 and 11 of the Richard B. Russell National School Lunch Act (42 USC 1757 and 1759a), maximum reimbursement rates for each type of lunch are prescribed by the Department in this Notice. These maximum rates are to ensure equitable disbursement of Federal funds to school food authorities.

Performance-based Reimbursement—In addition to the funding mentioned above, school food authorities certified as meeting the meal pattern and nutrition standard requirements set forth in 7 CFR parts 210 and 220 are eligible to receive performance-based cash assistance for each reimbursable lunch served (an additional nine cents per lunch available beginning July 1, 2024, and adjusted annually thereafter).

Afterschool Snack Payments in Afterschool Care Programs—Section 17A of the Richard B. Russell National School Lunch Act (42 USC 1766a) establishes National Average Payments for free, reduced price and paid afterschool snacks as part of the National School Lunch Program.

Breakfast Payment Factors—Section 4 of the Child Nutrition Act of 1966 (42 USC 1773) establishes National Average Payment Factors for free, reduced price, and paid breakfasts served under the School Breakfast Program and additional payments for free and reduced-price breakfasts served in schools determined to be in “severe need” because they serve a high percentage of free and reduced eligible children.

Adjusted Payments

The following specific section 4, section 11, and section 17A National Average Payment Factors and maximum reimbursement rates for lunch, the afterschool snack rates, and the breakfast rates are in effect from July 1, 2025, through June 30, 2026. Due to a higher cost of living, the average payments and maximum reimbursements for Alaska, Guam, Hawaii, Puerto Rico, and Virgin Islands are higher than those for all other States. The District of Columbia uses figures specified for the contiguous states. These rates do not include the value of USDA Foods or cash-in-lieu of USDA Foods which schools receive as additional assistance for each meal served to participants under the program. A notice announcing the value of USDA Foods and cash-in-lieu of USDA Foods is published separately in the Federal Register.

Adjustments to the national average payment rates for all lunches served under the National School Lunch Program, breakfasts served under the School Breakfast Program, and afterschool snacks served under the National School Lunch Program are rounded down to the nearest whole cent.

Special Milk Program Payments

For the period July 1, 2025, through June 30, 2026, the rate of reimbursement for a half pint of milk served to a non-needy child in a school or institution that participates in the Special Milk Program is 26.75 cents. This change is based on the 0.67 percent decrease in the Producer Price Index for Fluid Milk Products from May 2024 to May 2025.

As a reminder, schools or institutions with pricing programs that elect to serve milk free to eligible children continue to receive the average cost of a half pint of milk (the total cost of all milk purchased during the claim period divided by the total number of purchased half pints) for each half pint served to an eligible child.

National School Lunch Program Payments

Overall, payments for the National School Lunch Program and the Afterschool Snack Program increased due to a 3.85 percent increase in the national average payment rates for schools and residential child care institutions for the period July 1, 2025, through June 30, 2026 in the Consumer Price Index for All Urban Consumers for the Food Away From Home series during the 12-month period May 2024 to May 2025 (from a level of 367.099 in May 2024, as previously published in the Federal Register to 381.228 in May 2025).

These changes are reflected below.

Section 4 National Average Payment Factors—In school food authorities that served less than 60 percent free and reduced-price lunches in school year (SY) 2023-2024, the payments for meals served are: Contiguous states—paid rate—44 cents (2 cents increase from the 2024-2025 rate), free and reduced price rate—44 cents (2 cents increase), maximum rate—52 cents (2 cents increase); Alaska—paid rate—71 cents (2 cents increase), free and reduced price rate—71 cents (2 cents increase), maximum rate—83 cents (4 cents increase); Guam, Hawaii, Puerto Rico, and Virgin Islands—paid rate—57 cents (2 cents increase), free and reduced price rate—57 cents (2 cents increase), maximum rate—67 cents (3 cents increase).

In school food authorities that served 60 percent or more free and reduced price lunches in school year 2023-2024, payments are: Contiguous states—paid rate—46 cents (2 cents increase), free and reduced price rate—46 cents (2 cents increase), maximum rate—52 cents (2 cents increase); Alaska—paid rate—73 cents (2 cents increase), free and reduced price rate—73 cents (2 cents increase), maximum rate—83 cents (4 cents increase); Guam, Hawaii, Puerto Rico and Virgin Islands—paid rate—59 cents (2 cents increase), free and reduced price rate—59 cents (2 cents increase), maximum rate—67 cents (3 cents increase).

School food authorities certified to receive the performance-based cash assistance will receive an additional 9 cents (adjusted annually) added to the above amounts as part of their section 4 payments.

Section 11 National Average Payment Factors—Contiguous states—free lunch—4 dollars and 16 cent (15 cents increase from the SY 2024-2025 rate), reduced price lunch—3 dollars and 76 cents (15 cents increase); Alaska—free lunch—6 dollars and 74 cents (25 cents increase), reduced price lunch—6 dollars and 34 cents (25 cents increase); Guam, Hawaii, Puerto Rico and Virgin Islands—free lunch—5 dollars and 41 cent (20 cents increase), reduced price lunch—5 dollars and 1 cent (20 cents increase).

Afterschool Snacks in Afterschool Care Programs—The payments are: Contiguous states—free snack—1 dollar and 26 cents (5 cents increase from the SY 2024-2025), reduced price snack—63 cents (3 cents increase), paid snack—11 cents (no change); Alaska—free snack-2 dollar and 4 cents (7 cent increase), reduced price snack—1 dollar and 2 cents (4 cents increase), paid snack—18 cents (no change); Guam, Hawaii, Puerto Rico and Virgin Islands —free snack—1 dollar and 64 cents (6 cents increase), reduced price snack—82 cents (3 cents increase), paid snack—15 cents (1 cent increase).

School Breakfast Program Payments

Overall, payments for the National School Breakfast Program increased due to a 3.85 percent increase in the national average payment rates for schools and residential child care institutions for the period July 1, 2025 through June 30, 2026 in the Consumer Price Index for All Urban Consumers in the Food Away from Home series during the 12-month period May 2024 to May 2025 (from a level of 367.099 in May 2024, as previously published in the Federal Register to 381.228 in May 2025).

These changes are reflected below.

For schools “not in severe need” the payments are: Contiguous states—free breakfast—2 dollars and 46 cents (9 cents increase from the SY 2024-2025 rate), reduced price breakfast—2 dollars and 16 cents (9 cents increase), paid breakfast—40 cents (1 cent increase); Alaska—free breakfast—3 dollars and 95 cents (15 cents increase), reduced price breakfast—3 dollars and 65 cents (15 cents increase), paid breakfast—62 cents (2 cents increase); Guam, Hawaii, Puerto Rico and Virgin Islands—free breakfast—3 dollars and 18 cents (12 cents increase), reduced price breakfast—2 dollars and 88 cents (12 cents increase), paid breakfast—51 cents (2 cents increase).

For schools in “severe need” the payments are: Contiguous states—free breakfast—2 dollars and 94 cents (10 cents increase from the SY 2024-2025), reduced price breakfast—2 dollars and 64 cents (10 cents increase), paid breakfast—40 cents (1 cent increase); Alaska—free breakfast—4 dollars and 73 cents (17 cents increase), reduced price breakfast—4 dollars and 43 cents (17 cents increase), paid breakfast—62 cents (2 cents increase); Guam, Hawaii, Puerto Rico and Virgin Islands—free breakfast—3 dollars and 81 cents (14 cents increase), reduced price breakfast—3 dollars and 51 cents (14 cents increase), paid breakfast—51 cents (2 cents increase).

Payment Chart

The payment chart illustrates the lunch National Average Payment Factors with the sections 4 and 11 already combined to indicate the per lunch amount; the maximum lunch reimbursement rates; the reimbursement rates for afterschool snacks served in afterschool care programs; the breakfast National Average Payment Factors including severe need schools; and the milk reimbursement rate. All amounts are expressed in dollars or fractions thereof. The payment factors and reimbursement rates used for the District of Columbia are those specified for the contiguous states.

This notice announces the annual adjustments to the national average payments, the amount of money the federal government provides states for lunches, afterschool snacks, and breakfasts served to children participating in the National School Lunch and School Breakfast Programs; to the maximum reimbursement rates, the maximum per lunch rate from federal funds that a state can provide a school food authority for lunches served to children participating in the National School Lunch Program; and to the rate of reimbursement for a half-pint of milk served to non-needy children in a school or institution that participates in the Special Milk Program for Children.

Guidance on Fees for Electronic Payment Services in the School Meal Programs

| DATE: | July 11, 2025 | |

|---|---|---|

| POLICY MEMO: | SP 18-2025 | |

| SUBJECT: | Guidance on Fees for Electronic Payment Services in the School Meal Programs | |

| TO: | Regional Directors Child Nutrition Programs All Regions | State Directors Child Nutrition Programs All States |

Purpose

This memorandum provides revised guidance for school food authorities (SFAs) participating in the school meal programs1 regarding fees charged when families use electronic payment services to add money to school meal accounts. It also reminds SFAs that they must offer a free and accessible method for all families to add money to school meal accounts. In line with USDA Secretary Brooke Rollins’ priorities, this refreshed guidance reduces administrative burden and clarifies statutory, regulatory, and administrative requirements.

This memorandum rescinds, effective immediately, SP 04-2025 Fees for Electronic Payment Services in the School Meal Programs, issued on Nov. 1, 2024, and supersedes SP 02-2015: Online Fees in the School Meal Programs, issued on Oct. 8, 2014.

Background

Many SFAs provide electronic payment options for families to add money to student school meal accounts. Companies providing these electronic payment options generally charge fees to the SFA or the user for processing the payments.

FNS Instruction 782-6, Fees for Lunchroom Services, explains the Food and Nutrition Service’s (FNS) longstanding policy that students participating in school meal programs may not be charged additional fees beyond the basic meal charge for services provided in conjunction with the delivery of these programs. Since publication of FNS Instruction 782-6 in 2010, electronic payment options have become increasingly popular. FNS is committed to ensuring the policy for electronic fees maintains access to healthy school meals while reducing burden for SFAs.

Requirements for Fees for Electronic Payment Services

Families that choose to use electronic payment services may be charged a fee, but only if SFAs also offer a free and accessible method for all families to add money to student meal accounts. SFAs must notify families of available payment options and any associated fees in ways that are easy to find and understand.

Additionally, SFAs must provide a method of making deposits to student meal accounts to meet the needs of families who do not have access to a computer, do not have a bank account, or prefer to make their payment by other means. Common methods of meeting these requirements include accepting cash or checks at school or by mail.

Best Practices and Strategies

SFAs can increase awareness of payment options, including free payment methods, by including information in:

- The meal charge policy provided to all families at the start of each school year and to families transferring to the school during the school year.2

- All communications regarding meal payment options, including the school district’s website, emails, and menus.

- Notices sent to families when a student’s meal account balance is low.

- The website used for the fee-based electronic payment service.

When providing information about school meals, SFAs should include a phone number for a designated person to call for information about free methods to add money to a student’s meal account.

While no longer required, it is still a best practice to not charge additional fees for electronic payment options or to work with service providers to limit fees. If fees are charged, SFAs are encouraged to use electronic payment systems that allow bank account/ACH transfers, as these fees are typically lower than fees for credit card transactions. SFAs also may use funds from the general fund, donations from outside organizations, or funds from the nonprofit school food service account to cover the cost of fees for electronic payments for school meals.

State agencies are reminded to distribute this information to program operators immediately. Program operators should direct any questions regarding this memorandum to the appropriate state agency. State agencies should direct questions to the appropriate FNS regional office.

Tina Namian

Deputy Associate Administrator

Child Nutrition Programs

1For the purposes of this memorandum, school meal programs include the School Breakfast Program, Special Milk Program, and National School Lunch Program, including Afterschool Snacks.

2Please see SP 23-2017, Unpaid Meal Charges: Guidance and Q&A, question 5, for additional information and suggested methods of communication.

This memorandum provides revised guidance for school food authorities (SFAs) participating in the school meal programs regarding fees charged when families use electronic payment services to add money to school meal accounts. It also reminds SFAs that they must offer a free and accessible method for all families to add money to school meal accounts.

Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA); Interpretation of “Federal Public Benefit”

Summary

This notice sets forth the interpretation that the U.S. Department of Agriculture (USDA) uses for the term “Federal public benefit” as used in Title IV of the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), PL 104–193, 8 USC 1611. In doing so, this notice supersedes any prior interpretation in any notice or other document issued by any USDA agency. This notice also describes and preliminarily identifies the USDA programs that provide “federal public benefits” within the scope of PRWORA.

Supplementary Information

I. Background

According to Section 401 of PRWORA, 8 USC 1611(a), aliens who are not “qualified aliens” are not eligible for any “Federal public benefit” as defined in 8 USC 1611(c). The prohibition set forth in § 1611(a) is subject to certain exceptions set forth in § 1611(b). The application of § 1611(a) and exceptions contained in 1611(b) are conceptually distinct from the meaning of “Federal public benefit” and is not addressed in this notice.

The statutory text, § 1611(c), defines “Federal public benefit” as “(A) any grant, contract, loan, professional license, or commercial license provided by an agency of the United States or by appropriated funds of the United States” and “(B) any retirement, welfare, health, disability, public or assisted housing, postsecondary education, food assistance, unemployment benefit, or any other similar benefit for which payments or assistance are provided to an individual, household, or family eligibility unit by an agency of the United States or by appropriated funds of the United States.” 8 USC 1611(c)(1). This definition, too, is subject to certain exceptions. See id. (c)(2) (setting forth certain exceptions to the definition of “federal public benefit”).

In addition, under Section 432 of PRWORA, as amended, to the extent required by law, providers of a nonexempt ‘‘Federal public benefit’’ must verify that a person applying for the benefit is a qualified alien and is eligible to receive the benefit. 8 USC 1642. While the verification requirement is necessary to proper enforcement of PRWORA, it is conceptually distinct from the meaning of the term “Federal public benefit” and this notice is not intended to address application of such requirement. Neither does this notice speak to “Federal public benefits” that may be subject to other statutory authority besides PRWORA regarding citizenship and alien eligibility.

II. Interpretation

Statutory construction “‘must begin, and often should end as well, with the language of the statute itself.’” United States v. Steele, 147 F.3d 1316, 1318 (11th Cir. 1998) (quoting Merritt v. Dillard, 120 F.3d 1181, 1185 (11th Cir. 1997). “The plain meaning controls.” United States v. Robinson, 94 F.3d 1325, 1328 (9th Cir. 1996) (citation omitted). The statutory language is clear: if a USDA program falls into either §1611(c)(1)(A) or (c)(1)(B), such benefits are not available to individuals who are aliens, unless (i) that individual is a qualified alien, or (ii) some other exception applies to the USDA program, either under §1611(b) or via the definitional limits on “Federal public benefit” set forth in (c)(2). Thus, the task is simple: construe the plain language of (c)(1)(A) and (c)(1)(B). Those provisions state that “Federal public benefit” means:

- Any grant, contract, loan, professional license, or commercial license provided by an agency of the United States or by appropriated funds of the United States; and

- any retirement, welfare, health, disability, public or assisted housing, postsecondary education, food assistance, unemployment benefit, or any other similar benefit for which payments or assistance are provided to an individual, household, or family eligibility unit by an agency of the United States or by appropriated funds of the United States.

If USDA “provide[s]” the (i) “grant, contract, loan, professional license, or commercial license,” or if the “grant, contract, loan, professional license, or commercial license” is “provided by” “appropriated funds of the United States,” then such item is a “Federal public benefit.” Similarly, if USDA “provide[s]” the “retirement, welfare, health, disability, public or assisted housing, postsecondary education, food assistance, unemployment benefit, or any other similar benefit,” or such “benefit” is “provided by” “appropriated funds of the United States,” then such benefit is a “Federal public benefit,” as long as the benefit is “provided to” one of three types of recipients: (i) “an individual,” (ii) a “household,” or (iii) a “family eligibility unit.”

- 1. Grant

Section 1611(c)(1)(A) reaches “any grant, contract, loan, professional license, or commercial license” provided by USDA. For purposes of PRWORA, a grant means the award of funding for an individual or entity to carry out specified activities without the direct involvement of USDA. USDA administers a multitude of grant programs, including those in which the grants go to institutions, states, local governments, private entities and private organizations. Sometimes the activity supported by the grant is carried out by the “recipient”; sometimes the recipient issues a subgrant to an individual or entity. For PRWORA purposes, the term “grant” includes any “subgrant” derivative of a grant.

- 2. Contract

Many USDA programs and activities are carried out by the use of contracts. For example, contracts are used by the Farm Service Agency to provide assistance to agricultural producers in the form of income support payments and by the Forest Service in conducting forest management activities to reduce the risk of wildfires. USDA also provides assistance and benefits to individuals and entities through the use of several different types of instruments including loan guarantees (e.g., programs of the Rural Development agencies), reinsurance agreements (core operations of the Risk Management Agency), cooperative agreements (agreements used by numerous USDA agencies when the agency is working with another party to accomplish a public purpose authorized by law) and “export credit guarantees” (financial assurances made available through programs administered by the Foreign Agricultural Service). In the context of PRWORA, all instruments that are contractual in nature that are used by USDA agencies are considered to be contracts.

With respect to any contract, professional license, or commercial license, PRWORA excludes from the definition of “Federal public benefit” “any contract, professional license or commercial license for a nonimmigrant whose visa for entry is related to such employment in the United States, or to a citizen of a freely associated state, if section 141 of the applicable compact of free association approved in Public Law 99-239 or 99-658 (or a successor provision) is in effect.” See 8 USC 1611(c)(2)(A).

- 3. Loan

The majority of loans made by USDA agencies are “recourse” loans meaning the borrower is responsible for repayment of the full amount of the accumulated principal and interest that has accumulated; in the event the loan collateral is forfeited, the borrower remains responsible for any difference between the value of the collateral and the amount of the outstanding loan balance (principal plus interest). Many loans made by the Commodity Credit Corporation (CCC), an agency and instrumentality of the United States within USDA, are “nonrecourse” loans meaning that a borrower may forfeit the loan collateral to CCC in full satisfaction of the loan. In the context of PRWORA, both recourse and nonrecourse loans are considered to be loans.

- 4. Commercial license

As in the case of contracts, various types of legal documents are considered by USDA to be a “commercial license” for PRWORA purposes. For example, 7 CFR 6.20(b) provides: “Effective January 1, 1995, the prior regime of absolute quotas for certain dairy products was replaced by a system of tariff-rate quotas. The articles subject to licensing under the tariff-rate quotas are listed in Appendices 1, 2, and 3 to be published annually in a notice in the Federal Register. Licenses permit the holder to import specified quantities of the subject articles into the United States at the applicable in-quota rate of duty. If an importer has no license for an article subject to licensing, such importer will, with certain exceptions, be required to pay the applicable over-quota rate of duty.” The United States Warehouse Act establishes a voluntary system under which parties that store agricultural commodities may obtain a license from USDA in lieu of obtaining licenses from states. These, and similar licenses are “commercial licenses” for PRWORA purposes. The Forest Service issues a variety of permits (i.e., “special use permits” issued under 36 CFR 251) that allow individuals and private entities the privilege of conducting activities on land administered by the Forest Service. These activities include non-commercial and commercial activities. If USDA issues a special permit that allows the holder of the permit to engage in a commercial activity, such permit is a “commercial license” for PRWORA purposes.

- 5. PRWORA Provisions Applicable to the Food and Nutrition Service (FNS)

As previously discussed, the application of §1611(a) is conceptually distinct from the definition of a “Federal public benefit” under §1611(c). Nonetheless, to avoid confusion the application of 8 USC 1615 to certain FNS programs is briefly discussed. Section 1615(a) provides:

Notwithstanding any other provision of [PRWORA], an individual who is eligible to receive free public education benefits under State or local law shall not be ineligible to receive benefits provided under the school lunch program under the Richard B. Russell National School Lunch Act (42 USC 1751, et seq.) or the school breakfast program under section 4 of the Child Nutrition Act of 1966 (42 USC 1773) on the basis of citizenship, alienage, or immigration status.

Further, §1615(b) provides:

Nothing in [PRWORA] shall prohibit or require a state to provide to an individual who is not a citizen or a qualified alien, as defined in section 1641(b) of [Title 8], benefits under programs established under the provisions of law described in paragraph (2).

In particular, the statutory provisions in paragraph (2) are “(A) Programs (other than the school lunch program and the school breakfast program) under the Richard B. Russell National School Lunch Act (42 USC 1751 et seq.) and the Child Nutrition Act of 1966 (42 USC 1771 et seq.)[;] (B) Section 4 of the Agriculture and Consumer Protection Act of 1973 (7 USC 612c note)[;] (C) The Emergency Food Assistance Act of 1983[;] [and] (D) The food distribution program on Indian reservations established under section 2013(b) of Title 7.”

Although they each fall within the meaning of “Federal public benefit” under §1611(c), FNS continues to administer the following programs in accordance with the superseding provisions of §1615:

- Food Distribution Program on Indian Reservations (FDPIR).

- The Emergency Food Assistance Program (TEFAP).

- Commodity Supplemental Food Program (CSFP).

- Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

- WIC Farmers’ Market Nutrition Programs.

- Senior Farmers’ Market Nutrition Programs.

- National School Lunch Program.

- School Breakfast Program.

- Child and Adult Care Food Program.

- Fresh Fruit and Vegetable Program.

- Special Milk Program.

- Summer Food Service Program.

- Summer EBT.

USDA Food and Nutrition Service Disaster Assistance. (FNS does not administer a distinct disaster assistance program but utilizes various flexibilities, waivers, and options within the nutrition programs to provide assistance. Therefore, 8 USC 1615 would continue to apply where relevant.)

III. USDA Programs

Programs and Activities of FNS

Federal Public Benefit Under the Meaning of §1611(c)(1)(A)

FNS administers a variety of grants, cooperative agreements, and contracts. FNS grants primarily fall into two categories – discretionary grants and mandatory grants. FNS Standard Operating Procedure (SOP) refer to cooperative agreements and grants under the term “grants.” Authority to enter into contracts, grants, and cooperative agreements in accordance with section 1472 of the National Agricultural Research, Extension, and Teaching Policy Act of 1977, is delegated to the Under Secretary for Food, Nutrition, and Consumer Services pursuant to 7 CFR 2.19. Other legal statutory authorities for such instruments include the Food and Nutrition Act of 2008, as amended, the Richard B. Russell National School Lunch Act, as amended, the Child Nutrition Act of 1966, as amended, and annual appropriations legislation.

Section 1611(c)(1)(A) applies to “any” of the instruments listed. The term “any” is all encompassing. Unlike its neighboring provision, subparagraph (B), §1611(c)(1)(A) is void of limiting language based on characteristics of the recipient(s) of the benefit or other factors if the contract, grant, loan, professional license, or commercial license is “provided by an agency of the United States or by appropriated funds of the United States.” Congress explicitly provided specific exceptions for contracts, professional licenses, and commercial licenses at 8 USC 1611(c)(2) and the absence of other qualifications on instruments listed at §1611(c)(1)(A) indicates there are no others. Therefore, FNS interprets §1611(c)(1)(A) that every grant, contract, loan, commercial license, and professional license, of any kind or nature whatsoever regardless of its authorizing statute or regulation provided by FNS or appropriated funds of the United States is a “Federal public benefit” without exception other than those contained at §1611(c)(2).

The statutory language at §1611(c)(1)(A) reaches all instruments listed if “provided by an agency of the United States or by appropriated funds of the United States.” Therefore, FNS considers a sub-grant and a sub-contract made from a prime grant or prime contract provided by FNS or appropriated federal funds to be a “Federal public benefit.” Accordingly, the ultimate beneficiaries to whom federal funds flow from a contract or grant provided by FNS or appropriated funds of the United States are recipients of a “Federal public benefit.” For example, if a food bank receives a grant which is used to purchase food for distribution, the individual who receives the food assistance has received a “Federal public benefit.”

As stated above, the applicability of other provisions of PRWORA is conceptually distinct from the question of what the term “Federal public benefit” means, and this Notice does not intend to address that question except to the extent of the brief discussion concerning §1615 above.

FNS issues commercial licenses by authorizing retailers to accept Supplemental Nutrition Assistance Program (SNAP) benefits pursuant to 7 CFR 278.1 and 7 USC 2018. Applicants are required to submit an application that FNS must approve. Only if authorized, may a retailer engage in the commercial activity of accepting SNAP benefits as payment for certain commercial goods. Therefore, FNS interprets “Federal public benefit” to include a retailer authorization to participate in SNAP because such authorization is in the form of a commercial license.

FNS administers 16 food and nutrition programs under a variety of statutes like the Food and Nutrition Act of 2008, Richard B. Russell National School Lunch Act, Child Nutrition Act of 1966, Agriculture and Consumer Protection Act of 1973, Emergency Food Assistance Act of 1983, and 7 USC 2013(b) (i.e., Food Distribution Program on Indian Reservations). All food and nutrition programs meet the definition of “Federal public benefit” pursuant to §1611(c)(1)(B). The 16 programs are as follows:

- The Supplemental Nutrition Assistance Program (SNAP).

- Nutrition Assistance Program for Territories.

- Food Distribution Program on Indian Reservations (FDPIR).

- The Emergency Food Assistance Program (TEFAP).

- Commodity Supplemental Food Program (CSFP).

- Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

- WIC Farmers’ Market Nutrition Programs.

- Senior Farmers’ Market Nutrition Programs.

- National School Lunch Program.

- School Breakfast Program.

- Child and Adult Care Food Program.

- Fresh Fruit and Vegetable Program.

- Special Milk Program.

- Summer Food Service Program.

- Summer EBT.

- Disaster Assistance

In particular, these are benefits “provided to an individual, household, or family eligibility unit by an agency of the United States or by appropriated funds of the United States.” As discussed earlier, some of the above programs are administered pursuant to 8 USC 1615 even though they are “Federal public benefits”. FNS also recognizes that the definition of “Federal public benefit” is inapplicable “with respect to benefits for an alien who as a work authorized nonimmigrant or as an alien lawfully admitted for permanent residence under the Immigration and Nationality Act qualified for such benefits and for whom the United States under reciprocal treaty agreements is required to pay benefits, as determined by the Attorney General, after consultation with the Secretary of State.” See 8 USC 1611(c)(2)(B).

IV. Verification and Economic Impact

Due to the multitude of USDA programs that are available to tens of millions of individuals, USDA will continue to evaluate the manner in which it will verify compliance with PRWORA. USDA will, to the maximum extent possible, minimize the imposition of reporting and information and information collection requirements. Similarly, USDA continues to analyze the economic impact of this interpretation, but at this time, has not found there to be significant economic impact. USDA will issue subsequent guidance on verification actions and a final determination regarding the economic impact of this interpretation.

This notice sets forth the interpretation that the U.S. Department of Agriculture uses for the term “Federal public benefit” as used in Title IV of the Personal Responsibility and Work Opportunity Reconciliation Act of 1996. In doing so, this notice supersedes any prior interpretation in any notice or other document issued by any USDA agency. This notice also describes and preliminarily identifies the USDA programs that provide “Federal public benefits” within the scope of PRWORA.

Guidance on the Interpretation of Discrimination Based on “Sex” in USDA Child Nutrition Programs

| DATE: | July 7, 2025 | |

| TO: | Regional Directors All Food and Nutrition Service Programs All Regions | State Directors All Food and Nutrition Service Programs All Regions |

| SUBJECT: | Guidance on the Interpretation of Discrimination Based on “Sex” in USDA Child Nutrition Programs | |

The U.S. Department of Agriculture’s (USDA) Food and Nutrition Service (FNS) administers child nutrition programs that reduce hunger for vulnerable children including USDA’s National School Lunch Program. For each of several reasons set forth below, USDA has rescinded the Biden Administration’s May 2022 Bostock policy update that sought to require federally-funded food and nutrition service programs to redefine discrimination by reason of “sex” under Title IX of the Education Amendments of 1972 (Title IX) and the Food and Nutrition Act of 2008 (FNA) as not based on just male or female, but also “gender identity.” Today’s guidance eliminates the illegal threats issued under the Biden Administration that mandated compliance with ever-evolving concepts of gender ideology as a condition for participation in USDA school programs.

State agencies are reminded that, in 2024, the Supreme Court permitted injunctions to remain in place against the Biden Administration’s regulatory definition of sex discrimination under Title IX to include gender identity. Department of Education v. Louisiana, 603 U.S. 866 (2024). Likewise, the legal basis for the Biden Administration’s May 5, 2022, FNS Bostock Policy Update has been rejected by numerous recent federal court decisions. Courts have determined that discrimination based on “sex” does not, under Title IX, include discrimination on the basis of “gender identity.” Adams v. Sch. Bd. of St. Johns Cnty., 57 F.4th 791, 812 (11th Cir. 2022) (en banc); Tennessee v. Cardona, 2025 WL 63795, at *3 (E.D. Ky. Jan. 9, 2025), as amended (Jan. 10, 2025) (“when Title IX is viewed in its entirety, it is abundantly clear that discrimination on the basis of sex means discrimination on the basis of being a male or female”); Texas v. Cardona, 743 F. Supp. 3d 824, 871 (N.D. Tex. 2024) (indicating that, in 1972, when Title IX was enacted, “ ‘sex’ carried an unambiguously binary meaning”), appeal filed, No. 24-10910 (5th Cir. Oct. 7, 2024); Neese v. Becerra, 640 F. Supp. 3d 668, 678 n.6 (N.D. Tex. 2022) (observing that, in 1972, “‘sex’ was commonly understood to refer to physiological differences between men and women – particularly with respect to reproductive functions”), vacated, 123 F.4th 751 (5th Cir. 2024), reh’g denied, 127 F.4th 601 (5th Cir. 2025). Accordingly, USDA concluded the Biden Administration’s May 5, 2022, FNS Bostock Policy Update was legally flawed. For this reason, USDA rescinds the May 2022 Bostock policy update and related guidance documents implementing that policy.1

USDA determined that its rescission was a reasonable exercise of its discretion to avoid the litigation risk it faced as a defendant in Rapides Parish School Board v. HHS, USDA, et al., no. 8:23-cv-00889-CEH, in which a public school board sued USDA, challenging the legality of the May 2022 policy update and related provisions. On July 2, 2025, the Department of Justice, on behalf of USDA, executed an agreement securing plaintiff’s dismissal of its complaint against USDA, in exchange for USDA’s rescission of the Biden Administration’s May 2022 policy update and related documents and guidance.

USDA also concluded that its rescission of the May 2022 policy update and related documents and guidance will conserve resources by exercising its enforcement discretion to terminate pending compliance reviews and by avoiding the waste of resources on future reviews and potential litigation to the extent they would be based on the now-rescinded 2022 policy update.

USDA will therefore apply the interpretation under the binding principles and provisions of the Department of Education’s 2020 Title IX Rule and USDA’s longstanding Title IX regulations, which are themselves consistent with President Trump’s Executive Order Defending Women from Gender Ideology Extremism and Restoring Biological Truth to the Federal Government.

Each of the foregoing reasons provided USDA with an independently sufficient reason to rescind the May 2022 Bostock policy update and related documents and guidance.

FNS therefore interprets “on the basis of sex” in Title IX of the Education Amendments of 1972 and other relevant sex-nondiscrimination laws to protect sex-based equality, which is at odds with the concept of gender ideology. USDA therefore has rescinded its 2022 policy update, which advanced an incorrect interpretation of discrimination on the basis of “sex” under Title in IX in conflict with controlling sex discrimination law. See, e.g., Louisiana, 603 U.S. 866. This now-cancelled policy resulted in harmful impacts on child nutrition programs. Because USDA’s 2022 policy update is rescinded in its entirety, state agencies, schools and other organizations administering FNS’s child nutrition programs should cease any reliance on this incorrect, and now-rescinded 2022 USDA/FNS Bostock policy update.

Sincerely,

James C. Miller

Administrator

Food and Nutrition Service

Rescinded Documents

The following documents are withdrawn based on a change in administration policy consistent with Executive Order 14168:

- USDA Memorandum from Roberto Contreras, Director of Civil Rights Division, Food and Nutrition Service, to Regional and State Directors Regarding CRD 01-2022 Application of Bostock v. Clayton County to Program Discrimination Complaint Processing—Policy Update (May 5, 2022);

- USDA Memorandum from Food and Nutrition Service to Regional and State Directors Regarding Questions and Answers Related to CRD 01-2022 Application of Bostock v. Clayton County to Program Discrimination Complaint Processing—Policy Update (May 5, 2022); and

- USDA Cover Letter from Roberto Contreras, Director of Civil Rights Division, Food and Nutrition Service, to Regional Program Directors and State Agencies Regarding Application of Bostock v. Clayton County to Program Discrimination Complaint Processing—Policy Update (May 5, 2022).

USDA has rescinded the Biden Administration’s May 2022 Bostock policy update that sought to require federally-funded food and nutrition service programs to redefine discrimination by reason of “sex” under Title IX of the Education Amendments of 1972 (Title IX) and the Food and Nutrition Act of 2008 as not based on just male or female, but also “gender identity.” Today’s guidance eliminates the illegal threats issued under the Biden Administration that mandated compliance with ever-evolving concepts of gender ideology as a condition for participation in USDA school programs.

FAQs for Suppliers and Manufacturers Publishing Data for the Child Nutrition Database

General Information

- 1. What is the Child Nutrition Database (CNDB)?

The CNDB is a nutrient database of foods for use in the school meal programs, including products produced for and sold to school food service. The CNDB includes nutrient data for the following 19 nutrients/components: calories, total fat, saturated fat, trans fat, cholesterol, sodium, carbohydrate, dietary fiber, protein, vitamin A, vitamin C, vitamin D, calcium, potassium, iron, ash, total sugars, added sugars, and moisture. The CNDB includes nutrient data from: USDA National Nutrient Database for Standard Reference (SR) Legacy Release; USDA Standardized Recipes; and food manufacturers, including USDA Foods in Schools, published to the USDA Global Branded Food Products Database (Branded Foods) through GS1 GDSN®. The CNDB is a required part of the nutrient analysis software approved by USDA for use in the National School Lunch Program and School Breakfast Program.

- 2. Which products should be submitted for the CNDB?

We encourage all food/beverage products that are produced for and sold to K-12 schools to be published to the CNDB. This includes, but is not limited to, processed foods with a Child Nutrition label and USDA Foods in Schools products with an active USDA Foods contract.

- 3. Where can I access the CNDB?

The CNDB is published on FoodData Central site on the CNDB page.

- 4. What is the difference between the Branded Foods Database and the CNDB?

The CNDB includes foods and beverages produced for and sold to K-12 schools and incorporates manufactured foods and beverages intended for school food service from the Branded Foods Database. Products that are published to Branded Foods and have the trade channel, “Child Nutrition Food Programs” will be published to the CNDB. Branded Foods is publicly available at https://fdc.nal.usda.gov/.

Entering/Submitting Data in GS1 GDSN®

- 5. How do I submit products for the CNDB?

When your product data is entered into GS1 GDSN® through a data pool provider, both “GLN 0861583000302 (USDA)” and the trade channel “Child Nutrition Food Programs” must be selected in order for your data to be published to the CNDB. See the “Guide to Successful Publishing” for detailed information about publishing to CNDB. Contact cnpntab@usda.gov for a copy of this guide.

- 6. What is a playlist and where do I find it?

A playlist is a template of the data required for a specific recipient of data from GS1 GDSN® through a data pool provider. Ask your data pool provider if they have a playlist for USDA Global Branded Food Products Database. If you use 1WorldSync, you can find the playlist in the top menu under “Item Name.” The playlist for the CNDB through Branded Foods is “USDA.” The attributes for all playlists selected will be shown in the left menu.

- 7. Where do I find the “trade channel” field?

The “trade channel” field is located under the “Purchasing and Delivery” attribute set. You can also type “trade channel” in the search field of the attribute set window on the left-hand side. Be sure to select “Child Nutrition Food Programs” for the trade channel to publish to the CNDB. You may select more than one trade channel.

Note: The location of this field may differ depending on data pool provider.

- 8. What should I submit for the “Product Description” field?

When entering the product description, enter the name that is shown on the product label or box. Do not include extra information such as marketing language or meal pattern contributions.

- 9. What should I use for "Nutrient Basis Quantity Type" field?

For every item published, there needs to be a “Nutrient Basis Quantity Type” and the associated “Nutrient Basis Quantity” to show the amount of product which the nutrient data being provided is based upon, such as “per 100 grams” or “per ½ cup”. The nutrient values entered must be for the “Nutrient Basis Quantity Type” and “Nutrient Basis Quantity” entered.

For the CNDB, use only one of the following for the “Nutrient Basis Quantity Type”:

- By Measure—Provide the nutrients per 100 basis of weight (100 gram [GRM] or 100 milliliter [MLT]). Note: Use only GRM or MLT units of measure if you select “By Measure.”

- By Serving—Provide the nutrients per serving size. Note: The serving size entered must match a serving size provided under the “Serving size” field. At least one serving size must be provided using grams (GRM), milliliters (MLT), or ounces (OZI or OZA) for weight.

A product can have more than one set of nutrient information. Each set would have a different Nutrient Basis. Different receivers of the product information may utilize the different sets of information for various solutions.

- 10. Is the serving size (label or household measure) required?

Yes, a serving size is required for Branded Foods and the CNDB. Please provide a label or household-type serving size, such as 0.5 cup, 10 pieces, 1 patty, 1 bowl, etc. You must provide at least 1 serving size with grams, ounces, or milliliters. Note that label or household serving sizes are most helpful for school users as it allows them to match this to the product they are using and avoid making conversions from weight measures.

Note: You can provide more than one serving size per food item.

- 11. How do I remove or mark an item as discontinued from the CNDB?

When the product is discontinued, we recommend you both remove the trade channel AND add the discontinued date. Remove the trade channel “Child Nutrition Food Programs” for items to be removed from the CNDB. These items may still appear in Branded Foods. If the product is discontinued from the market and will no longer be produced, you should enter the date the product is discontinued in the “discontinuedDate” or “endAvailabilityDate” fields.

- 12. When will the data entered in my data pool provider be included in Branded Foods and the CNDB?

After you successfully publish your data in your data pool provider’s site, it takes 1–2 months for the data to appear in Branded Foods, depending on when your data is entered. The CNDB is updated monthly on the same schedule as Branded Foods. Vendors may publish and provide updates to their product data at any time. The CNDB update will include the most recent data provided to GS1 GDSN® through the Branded Foods Global Location Numbers (GLN) with trade channel “Child Nutrition Food Programs.”

Publishing Data for USDA Foods to the CNDB

- 13. What is the difference between the two USDA Global Location Numbers (GLNs)?

“GLN 0861583000302 (USDA)” is for the USDA Global Branded Food Products Database (Branded Foods). Manufacturers who sell food and beverages to school food service who would like their data included in the CNDB should publish to this GLN.

“GLN 0861583000319 (USDA – FNS)” is for the USDA Foods Database for USDA Foods in Schools. If you are an approved USDA Foods supplier with an active USDA contract to supply USDA Foods in Schools products, you are required to publish to this GLN, as indicated in the AMS Master Solicitation for Commodity Procurement.

If you are not an existing USDA Foods supplier, do not publish to this GLN. To learn more about this requirement, visit: https://www.ams.usda.gov/selling-food/gs1-gdsn-requirement. Manufacturers who are required to publish to GS1 GDSN® for the USDA Foods Database are encouraged to also publish to the Branded Foods GLN for inclusion in the CNDB.

- 14. How do I publish to GS1 GDSN® for both the USDA Foods Database (USDA – FNS) and CNDB through Branded Foods (USDA)?

You may publish your data to more than one GLN in GS1 GDSN®. All foods and beverages published to the USDA Foods GLN (USDA – FNS), may also be published to the Branded Foods GLN (USDA). To publish to the CNDB, the trade channel “Child Nutrition Food Programs” is also required. Products can also be published to other organizations such as distributors, school systems, retailers, etc.

- 15. What is the FNS Material Number or USDA Foods Material Code (WBSCM#)?

The FNS Material Number or USDA Foods Material Code (WBSCM#) is the 6-digit unique identifier that specifies each USDA Foods product. If you are a USDA Foods supplier and also publish for the CNDB, the WBSCM# will automatically publish to the CNDB.

Correcting Errors and Additional Help

- 16. How do I know if I provided the required attributes for the CNDB/Branded Foods database?

After inputting your data for your foods in your data pool provider’s site, click “validate” to ensure the correct attributes have been provided. If there is missing or incorrect data, you will see error and warning messages. Please address all errors and warnings to ensure successful publication.

- 17. What are the different types of errors and warnings?

Error messages relate to missing required data. These must be fixed before the product can be published successfully.

A “Warning” message is not an error, but a recommendation. You are still able to publish your data with warning messages. While these recommendations do not have to be addressed for publication, you are encouraged to address them to provide a more robust set of product data. Read the messages carefully to determine if it is required or recommended. If you have questions about the messages from your data pool provider, please contact them to ensure your data can be published.

- 18. How do I check my data after it is published?

From your home dashboard, you can view the status of your published items. If there are any synchronization errors, your data will not be published.

You may check if your submitted products have been submitted correctly to the CNDB within the Branded Foods section of FoodData Central. Search for your product within the search field. Be sure to filter on the “Child Nutrition Food Programs” trade channel. If your products appear, then they should be included in the next release of the CNDB, as long as the required nutrients are included and the data passes the quality control checks.

Please note, products published to Branded Foods will not appear in the database until the subsequent month (e.g., if published before May 1, data will be in Branded Foods in the May update, which occurs mid-month, if published after May 1, it will appear in Branded Foods with the June update).

- 19. What are Catalogue Item Confirmation (CIC) messages and how does one respond to them?

CIC messages from your data pool provider are errors and warnings shown on the provider dashboard. Errors result when required data is missing or incorrect and must be fixed before you are able to publish your data. The item can be saved with warnings and the publisher will receive a CIC message. Errors must be corrected before you can successfully publish your data. Warnings do not have to be addressed for publication.

- 20. Who should I contact when I have issues with submitting/publishing data?

First, contact your data pool provider if you have questions about the data entry for your products to be published to the CNDB. Be sure to read the CIC messages from the data pool provider and address errors. 1WorldSync works directly with Branded Foods and the CNDB and is most familiar with the needs for these databases. Please reach out to the 1WorldSync at: technicalsupport@1worldsync.com. Contact the CNDB team at cnpntab@usda.gov if you require additional assistance.

Frequently asked questions and answers for suppliers and manufacturers publishing data for the Child Nutrition Database.

Reimbursement for Off-Site Meal Consumption

| DATE: | July 1, 2025 | |

| POLICY MEMO: | SP 17-2025 | |

| SUBJECT: | Reimbursement for Off-Site Meal Consumption | |

| TO: | Regional Directors Child Nutrition Programs All Regions | State Directors Child Nutrition Programs All States |

Purpose

The purpose of this memorandum is to provide clarification to state agencies and school food authorities (SFAs) operating the National School Lunch Program (NSLP) and School Breakfast Program (SBP) on reimbursement for meals consumed or served off site. This clarification supports the guiding principles regarding nutrition programs identified by USDA Secretary Brooke Rollins, which include commitments to clarify statutory, regulatory, and administrative requirements and to infuse each nutrition program with new energy and vision. This memorandum supersedes FNS Instruction 786-8 REV. 1, Reimbursement for Off-Site Meal Consumption.

Background

The Richard B. Russell National School Lunch Act (NSLA), (42 USC 1753(b)(1)(A)), and the Child Nutrition Act of 1966 (CNA), (42 USC 1773(b)(1)(A)) require that meals reimbursed under the programs are to be served in school or school-related premises. FNS Instruction 786-8 REV. 1, Reimbursement for Off-Site Meal Consumption stated that meals served or consumed off site could only be reimbursed if children were participating in school functions that are part of the curriculum, as defined by the state education agency, and could not be reimbursed if children were off site for extracurricular events.