| DATE: | August 18, 2009 |

| SUBJECT: | SNAP - Standard Utility Allowance (SUA) Annual Review and Adjustment Biennial Option - Blanket Waiver of S 273.9 (dx6)(iii) |

| TO: | Regional Directors Supplemental Nutrition Assistance Program All Regions |

Federal regulations at § 273.9 (d)(6)(iii)(B) allow a state agency, with approval from Food and Nutrition Service (FNS), to develop a Standard Utility Allowance (SUA), to be used in place of actual utility costs in determining a household's excess shelter deduction. It has come to FNS's attention that, due to unusual shifts in utility costs, Supplemental Nutrition Assistance Program (SNAP) benefits to needy families may decrease when states make annual SUA adjustments this year - even if the circumstances of those households remain constant. This memorandum serves as a onetime blanket waiver of the regulations at § 273.9 (d)(6)(iii)(B) which require state agencies to update SUAs annually.

This waiver allows states to make a biennial adjustment to the SUA in 2010 rather than an annual adjustment in 2009, if an annual 2009 adjustment would result in a decrease in SNAP benefits to households. Electing a biennial adjustment to the SUA means that the state agency will make adjustments to reflect changes in costs over two years rather than making an annual adjustment in 2009.

Background

As provided by SNAP rules, the SUA calculation may include the cost of fuel for heating and cooling, electricity or fuel used for purposes other than heating or cooling, water, sewage and other utility costs. State agencies may develop different kinds of SUAs - for example, an individual standard for each type of utility expense or an SUA for all utilities that includes heating or cooling costs (an HCSUA) - but cannot allow households the use of two standards that include the same expense. State agencies may also vary the allowance by factors such as household size, geographic area, or season.

All states except the Virgin Islands use SUAs.

Federal regulations at § 273.9 (d)(6)(iii) state:

(B) The state agency must review the standards annually and make adjustments to reflect changes in cost, rounded to the nearest whole dollar. State agencies must provide the amounts of standards to FNS when they are changed and submit methodologies used in developing and updating standards to FNS for approval when the methodologies are developed or changed.

Description

SUAs are updated annually as provided by regulations at § 273.9 (d)(6). Typically, SUA values increase slightly each year as the cost of energy rises over time. This year, for some states, the cost of certain utilities may be lower than the cost last year. This means that the adjusted value of an SUA will be less than it was last year. When a new, lower-value SUA is put into effect, a household with the same gross income will have a smaller SUA deduction, resulting in a higher net income calculation which would dictate a lower value for SNAP benefits. Therefore, a household that has no change in household circumstances may experience a decrease in benefits from one month to the next simply because an adjusted, lower-value SUA is implemented. Refer to the "Example of Implementation" below for numerical examples.

In order to maintain benefit stability and to preserve the stimulative effects of the American Recovery and Reinvestment Act of 2009 (ARRA), FNS is allowing state agencies to adjust SUAs over a two-year time frame if benefits would otherwise be decreased by the annual SUA adjustment for 2009.

FNS also notes that utility prices tend to be more dynamic than food, housing or other indices. Allowing states to adjust over a two year period, rather than a one-year period, will result in an update that reflects the change in utility costs over two years and may help to avoid a significant decrease in SNAP benefits to needy families that could result from a mandatory SUA update for 2009.

Example of Implementation

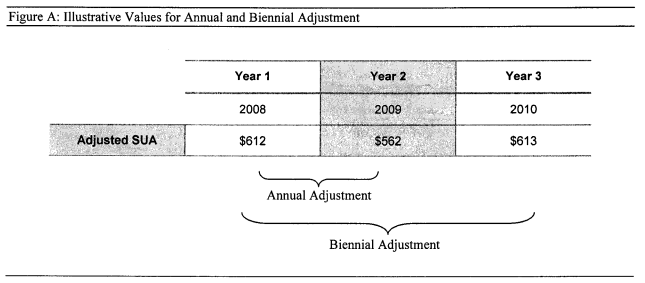

This example is designed to clarify the concept of a biennial SUA adjustment versus an annual SUA adjustment during the years 2008 through 2010. The following SUA figures are illustrative; each state has its own procedures for calculating SUAs. Note that the SUA adjustment uses a base figure from the previous SUA adjustment (typically, the adjusted SUA from the previous year).

Example 1: Adjusting Annually in 2009. If a state agency were to undertake an annual review and adjustment for this SUA in 2009, the state would determine that the value of the SUA decreased by $50 between 2008 and 2009. Implementing this change in SUA would result in a household with no change in household circumstances experiencing a $15 decrease in SNAP benefits in 2010. In Figure A, this is indicated by the bracket labeled "Annual Adjustment."

Example 2: Adjusting Biennially in 2010. If a state agency determines that an annual adjustment in 2009 would cause a decrease in benefits to clients, the state agency may choose to instead adjust biennially in 2010. In this example, if a state to makes a biennial adjustment in 2010, the agency would find that the value of the SUA increased by $1 between 2008 and 2010. Implementing this change in SUA would mean that a household with no change in household circumstances would receive approximately the same benefit amount in 2011 as it did in 2009 and 2010. In Figure A, this indicated by the bracket labeled "Biennial Adjustment."

States that opt to implement the biennial review and adjustment to the SUA rather than an annual review in 2009 must notify their regional office and regional offices should notify the Certification Policy Branch.

Arthur T. Foley

Director

Program Development Division